How to Fly for Free every 3 Months

A Total Beginner’s Guide to Travel Hacking #

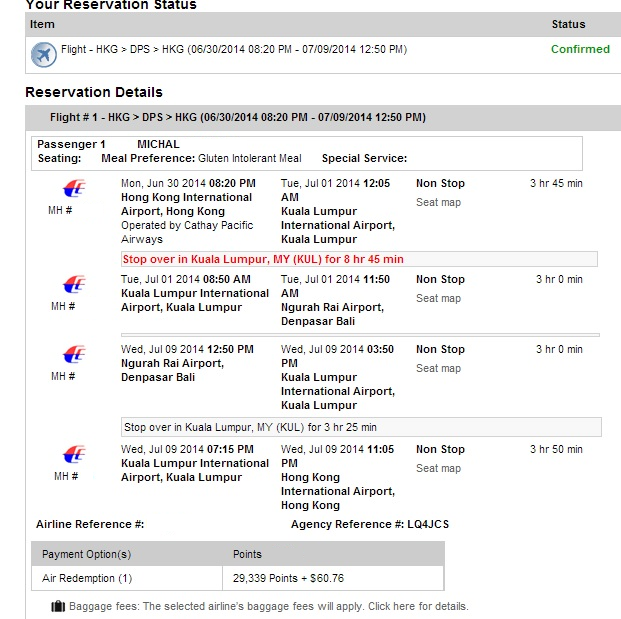

Last week I booked a little getaway: Shanghai to Hong Kong to Indonesia with a long stopover in Malaysia - and back. In Hong Kong, I’ll be handling visa matters and seeing old friends; I’ll have enough time in Malaysia to see the Petronas Towers & Mindvalley; and Bali, Indonesia promises both incredible environment and people, if the nomad hackers at Eleven Yellow are any indication.

Here’s the kicker: I booked all my flights one week in advance and paid USD 60 for everything. I won’t be alone: a good friend coordinated his Bali trip from San Francisco for pennies on the dollar with this exact strategy. Sound like a dream vacation? I’m going to show you every step I took to make this happen, and in 3 months you can tell me how your trip was even better.

This process works by accruing as many rewards points as possible, as quickly and cheaply as possible. Your results may vary, but I can usually pull off a free international one-way or round-trip on the same continent with this every 3 months. This post is purely informative, and I make no guarantees of any sort to anyone applying these steps. The biggest caveat of all: as of 2014, this process requires a United States bank account & US Amazon Payments account. I’d love to hear about global alternatives you find!

Since this post went up, I’ve been invited to share these tactics with the Under 30 Changemakers and the Stanford Salon communities. Scroll to the end of this post for a video introduction!

First, The Card #

Maximizing your 3 month travel turnover requires a strong foundation: a really great travel rewards credit card. Your typical card will make this offer: spend USD X,000 in the first 3 months and get 25,000-50,000 reward points, which can amount to as much as USD 600 in travel spend.

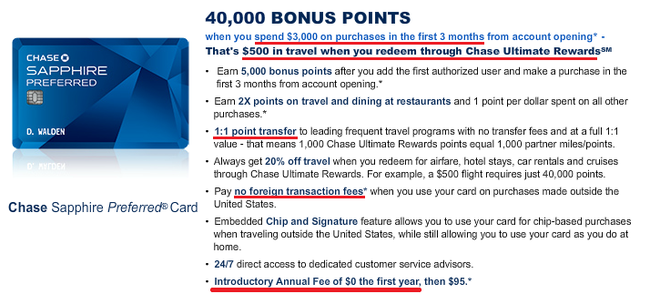

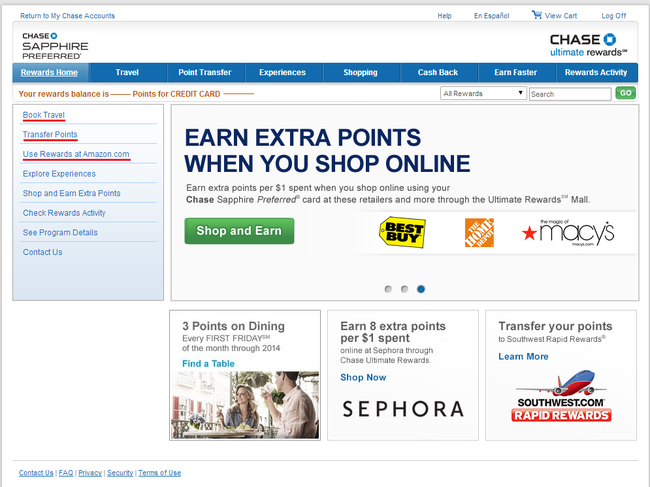

For this trip, I used the Chase Sapphire Preferred card. ThePointsGuy has some stellar & up-to-date recommendations. I don’t get any kickbacks for recommending this card - I legitimately think it’s good.

UPDATE On November 2014, Chase upped the minimum spend on the Chase Sapphire Preferred to $4,000 in the span of 3 months. The card is still great, but this makes using it less perfect for this strategy. I suggest looking into the Barclay Arrival+ Mastercard for a great offer on a $3,000 spend.

Here’s what you’re looking for: #

- The points: aim for at least 30,000 bonus points, more is better.

- Reasonable minimum spend: aim for USD 3,000 in first 3 months.

If the requirement is not more than USD 1,000/month, you will not need to use the card at all except in the Payment step. That’s 3 uses in 3 months. If more than USD 1,000, you’ll need to spend on your own or use additional services like Venmo or PayPal to meet the limit.

- Waived annual free for the first year: this allows you to incur no cost over the lifetime of the card if you close the account before the end of the first year.

If you’re going to use the card normally, some tips: #

- A great extra is no international transaction fees, which is perfect for travelers already on the move.

- A strong points transfer program is key if you have a preferred airline or hotel provider.

- Look for a good point bonus program for purchases you make often, like groceries or dining out. Some cards offer 5x points per dollar spent on certain categories like gas stations.

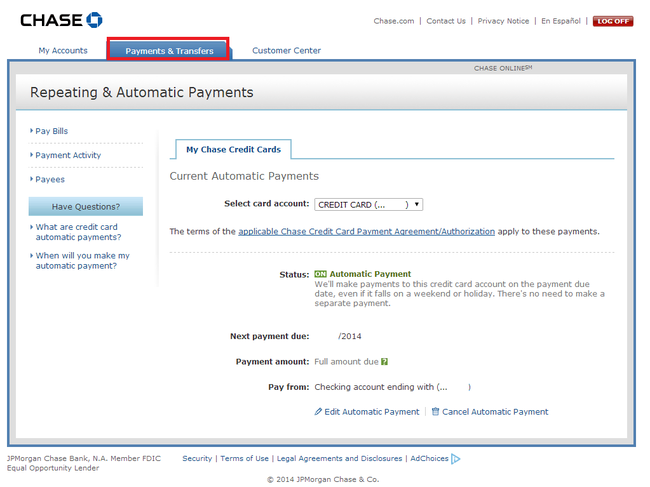

Once you have the card, connect your bank account with the card for automatic payments to avoid any screw-ups. This makes the entire process almost automated. While you’re at it, go for paperless statements & save the planet!

Next, The Payments #

To get those juicy points, you’re going to need to spend a certain amount of money each month on the card for the first three months. This differs by card, but if your minimum monthly spending requirement to get at those points is under USD 1,000 you will only ever need to use this card 3 times - and it won’t cost you anything. How? You’re going to need a trusted friend, because you’ll be sending each other a bunch of money.

UPDATE: Naturally, this was too good to be true, right? Some three years after the idea was first broken, Amazon has finally shut down this service on October 2014. Some great alternatives come from MillionMileSecrets. For simplicity’s sake, I suggest spending everything you can on your card and supplementing any remainder with Venmo transfers.

Charge Cards: Alternatives still exist in the form of the BlueBird and Serve cards, which can be used to leverage credit in payment of bills, rent, and even college loans. You can use your travel card to charge these cash cards with as much as $1,500/month to be used for any transactions that would ordinarily require a check.

Virtual Transfers, with Fee: For fully hands-off minimum spend generation, Venmo charges a 3% fee while PayPal charges 2.9% + $0.30/transaction. These are not great solutions for creating spend compared to simply making purchases.

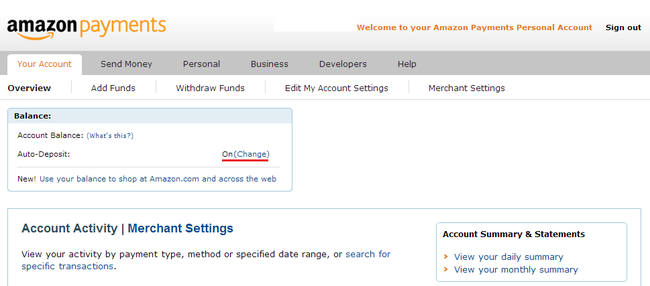

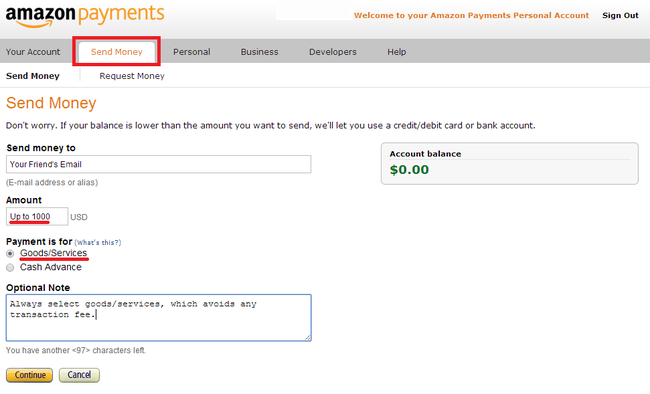

Amazon Payments is awesome: it lets you charge a credit card or bank account for up to USD 1,000 every 30 days for free. I haven’t found any other service that offers no service charge on credit card transactions. You can set up auto-deposits to your bank account, too.

- Set up your Amazon Payments profile: create a login, connect your bank account, and your credit card. You’ll need all three to send and receive money, and it can be a pain: you may be asked for confirmation on both the card and bank, and required to send a picture of your ID. This is a one-time thing, and worth doing. If you can’t be bothered, Venmo is easier to set up.

Make sure your friend has a profile set up, too. He or she will need it to send the full amount back to you. You’ll need to know each others’ Amazon account emails for the next part.

- Send USD 1,000 to your friend: Make sure to select “Payment for Service/Goods,” or you will incur a service charge on the transaction. Also make sure they’ll return the cash to you in a timely fashion to the same bank account with which you pay off your credit card. You can use “Request Money” for this.

Do this every billing cycle. The easiest way is to set a reminder for 30 days from the first time you do it, but keep in mind the transaction can take 3-5 days to show up on your billing statement, so don’t wait until the last minute.

If you need to spend +USD 1,000 #

Venmo is a solid choices to put additional spending on your card in the same way, but they charge a transaction fee of 3-5%. That’s as high as USD 25 on a USD 500 transaction, best avoided. Remember: if you’ve grabbed a card with over USD 1,000/mo spend and you’re desperate, you can always buy prepaid cash cards or gift cards online!

Last, The Trip #

At the end of three months, you’ll have accrued some points from your spending, and then receive a fat bonus from hitting the minimum monthly spend. If you don’t already have a global bucket list, try Krakow, Hong Kong, and Costa Rica to start - no visas required for US citizens.

Since you’ll most likely be purchasing your ticket through the card’s reward service, the absolute best deals you find on Kayak or ITA Travel Matrix won’t show up.

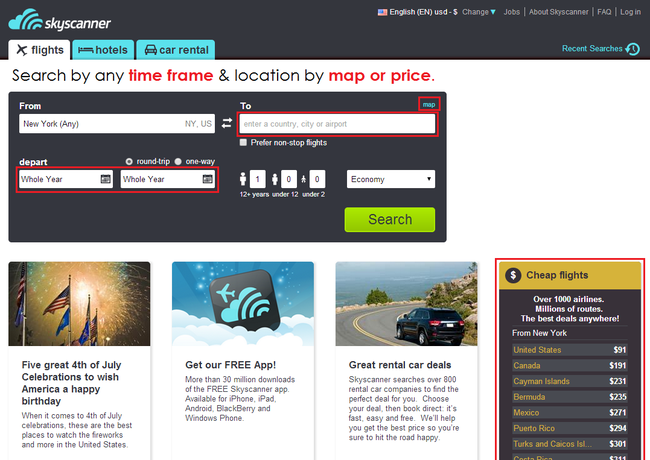

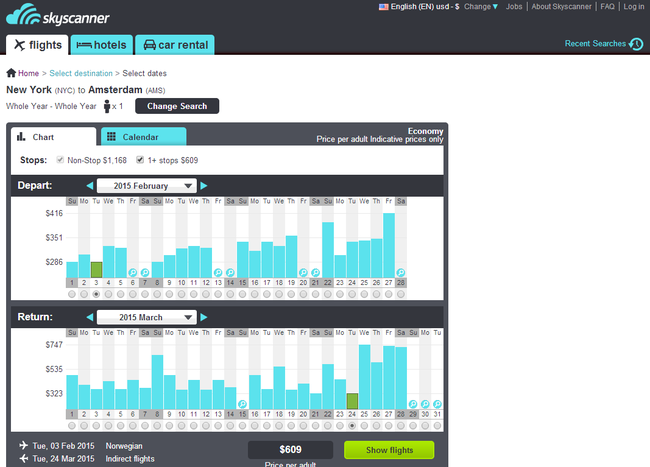

Still, it pays to know your best travel times & locations. I think nowhere is better for this than SkyScanner: you can search the entire globe for a year’s worth of travel deals and hone in on the best day to make your getaway. With their search by price of map, you don’t even need to know where you want to go.

Cherry on Top: Frequent Flyer Points #

Double-check if your chosen airline provider offers a membership at MillionMileSecrets, set up an account, and throw your account number in the “Frequent Flyer Number” field at checkout.

Once you’ve decided on where to go and when, you’re ready to pull the trigger on your trip. Search for the same deal you found on SkyScanner and book through your credit rewards platform. If you’d like to avoid the annual charge on the card, set a reminder to cancel after you return from your trip. Remember to pack light.

Can’t decide? My favorite way to open myself up to inspiration is with IFTTT alerts for crazy travel deals from my favorite travel hacker websites: Secret Flying, The Points Guy, and The Flight Deal.

With these “recipes,” whenever any of these sites publishes a crazy deal you’ll receive a notification on your phone - or if you prefer, by email, Twitter, Slack, on Pebble, you name it. See the full list here.

Another smart idea is to sign up for travel alerts from top airlines.

Read Next: What’s in Your Backpack?

The phrase “travel hacker” usually summons one of two reactions: hopeful confusion or scornful disbelief. “Wow, I wish I could live like that,” or “This can’t possibly be legal” is about on point. For most people, trips like this can take a month of planning, at least a few hundred bucks, and a nervous freak-out. Worse yet at those who swear they’d love to travel, and maybe even have a full trip planned they talk about passionately - if only they just had the money and time! It’s legal and it can be easy - and this is just the tip of the iceberg.

This trick takes about an 4 hours of time over the course of 3 months - not counting deciding where to go - and won’t cost you a thing if you follow all the directions. #

Tried this out? Let me know. #

For an accelerated introduction or beginner’s summary, check out our talk to the Under 30 Changemakers community.

One last thing: check out The Digital Nomad Guide! #

In 2014 or so, I wrote a “soft landing” guide for work-play travelers who were making their way into some of the classic Southeast Asian digital nomad hubs. Written for Derek Sivers’ WoodEgg brand, the book can be purchased for $27 alongside his excellent Business in Asia guides. Here’s an excerpt:

The day you wake up to the sound of waves lapping at the sand steps away from your bungalow, a fresh breakfast of eggs and fruit waiting for you next to your laptop, with everything else you own stuffed in a small backpack that has been with you across the world – it might feel like you’ve made it. In this life, you might have less than 100 items to your name, trading in beautiful clothes, homes, and cars for access to incredible experiences on every continent. Your livelihood will depend on your access to good WiFi. You might think of it like a fundamental human right. Your now twice-extended passport might have more stamps than a post office, or you may have fallen in love with the first place you drop into.

The lifestyle of a digital nomad can seem like the stuff of fantasy. Our office is any flat surface. Our home is wherever we set our backpack. Our deepest friendships are sometimes with people we’ve never met in real life. “Where are you from?” becomes gradually more difficult to answer. But in many cities – from Las Vegas and Berlin, to Bangkok and Bali, and Buenos Aires to Medellin – you’ll find us in your cafes, your beaches, your hotel lounges, your coworking spaces doing the hard work to make this lifestyle a continued reality. Becoming a nomad is not leisure. As you just start out, it may feel like you’ve entered poverty compared to your past life. Your initial work weeks will be 60 or 80 hours, not 4 – and this will last for months or years.

A digital nomad is anyone who uses the advances in communication technology to create value regardless of location, freeing him or herself to work remotely. We use the Internet to scale and automate a business or provide services remotely, creating financial and time freedom to do the things a traditional work-life balance makes impossible to fit in.

But when you’ve built something that exists beyond you, that provides value to others for which they’re happy and willing to pay, and you’ve cut down on your anchors and expenses to create geographic independence and freedom of time – that is when you have made it, not into a life of idle relaxation, but one of choices.

That said, this is not the book on how to build your first online business. You’ll find hundreds of those. It’s the book about where to do it, how to make the most of it, and how to make a home for yourself on the road. Compiled from over 400 interviews with entrepreneurs, writers, consultants, and technologists living nomadically or far from home during a 2 year research quest by Derek Sivers’ Wood Egg project, the Go to Launch Nomad Guide is compiled from personal stories and expertise of those who have been in your shoes and have started moving forward on an adventure-rich lifestyle of their own design.